Why Pay Bills Online?

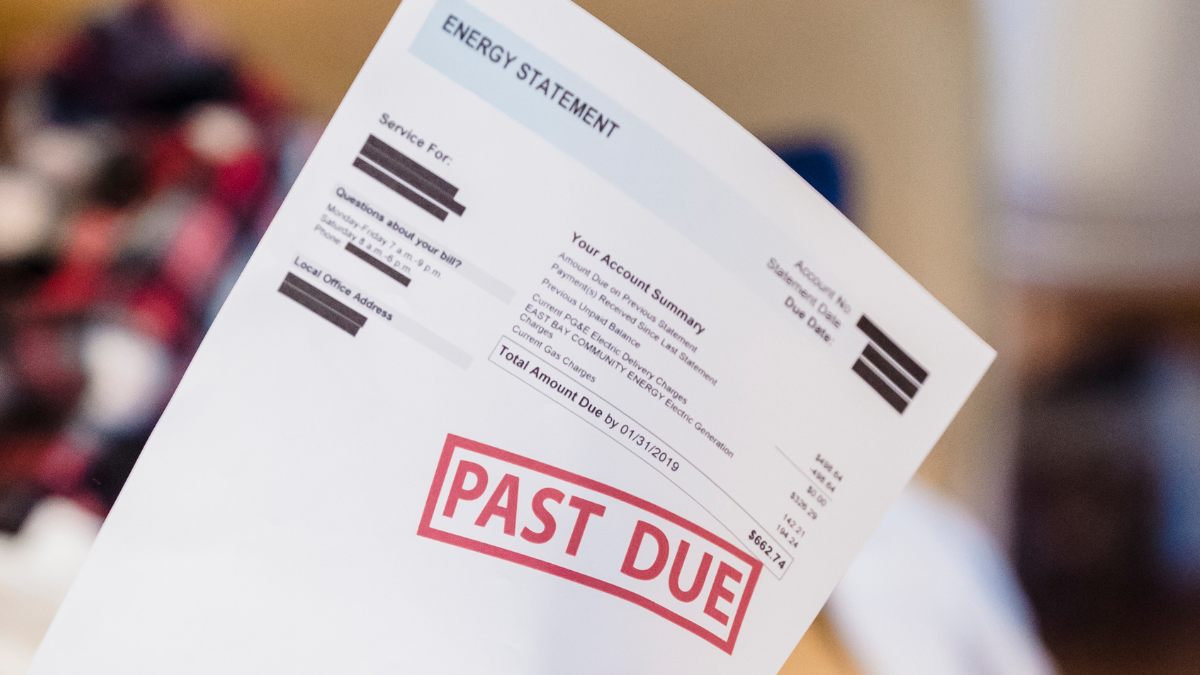

Paying bills online is one of the easiest ways to stay on top of your finances. It saves time, reduces paperwork, and helps you avoid late fees. You can pay from anywhere — whether it’s rent, utilities, credit cards, or streaming services.

Here’s why it makes sense:

- Pay from anywhere: At home, work, or on the go — access your bills online anytime.

- Avoid late fees: Set reminders or automate payments to stay on schedule.

- Digital records: No lost checks or misplaced paper receipts — everything is tracked online.

- Eco-friendly: Reduce paper waste by paying electronically instead of by mail.

And once you open a bank account, online bill pay is one of the first tools to take advantage of.

Common Ways to Pay Bills Online

Here are the most popular ways to pay your bills online:

Through Your Bank’s Website or App

Most banks offer free online bill pay. You log in to your account, add your payees (companies you want to pay), and schedule payments directly from your checking account.

On the Provider’s Website

You can also pay directly through the service provider’s website — for example:

- Utility company

- Credit card issuer

- Internet or phone provider

- Streaming services

Using Third-Party Apps

Apps like PayPal, Venmo, and others allow you to pay certain types of bills, though not all providers accept them.

If you’re not sure whether your current bank is good for online payments, see this list of the Best Checking Accounts 2025 with strong online features.

Common Bills People Don’t Usually Pay Online — But Should

Many people still pay some bills by check, phone, or in person — but moving them online can save time and help you avoid missed payments. Here are some examples of bills you may not be paying online yet (but should consider):

- Rent: Many landlords now offer online payment options through apps or bank transfers — faster and more trackable than mailing a check.

- HOA (Homeowners Association) fees: HOA payments can often be automated through your bank or a third-party portal.

- Insurance premiums: Auto, health, renters, and home insurance can all be paid online — often with options for autopay.

- Medical bills: Many healthcare providers now offer online payment portals to make paying bills easier.

- Tax payments: In many cases, local and federal taxes (property tax, IRS estimated payments) can be paid online — no need to mail checks.

- Childcare or school tuition: Many schools and daycare centers now accept online payments through portals or apps.

Moving these bills online can help you automate your finances, avoid late fees, and keep better records.

Payment Methods You Can Use for Online Bill Pay

When paying bills online, you usually have several payment options — depending on your bank or the service provider. Here are the most common ways you can pay:

- Bank transfer (ACH): The most common and reliable method. Funds are transferred directly from your checking account to the payee.

- Debit card: Many providers accept debit card payments online — useful for instant processing.

- Credit card: You can often pay bills like utilities, streaming services, and insurance premiums with a credit card — which can help you earn rewards. Be mindful of fees or potential interest charges.

- PayPal: Some companies (especially subscription services and certain utilities) let you pay through PayPal.

- Bill pay services: Some third-party services and financial apps offer online bill pay — letting you choose your payment method and automate recurring payments.

Tip: For essential bills (rent, mortgage, auto loans), paying directly from your bank account is often the most cost-effective and reliable method.

How to Set Up Online Bill Payments

Getting started is easy — here’s how:

- Go to your bank’s website or your bill provider’s site and log in to your account.

- Look for the “Bill Pay” section and add the companies or individuals you want to pay.

- Input how much you want to pay and the due date.

- You can send the payment immediately or schedule it for the due date. Many banks offer setting up automatic payments — perfect for recurring bills like rent or subscriptions.

Tips for Managing Online Payments

Once you’ve set it up, managing online payments is simple — but here are some smart tips:

- Review statements before paying. Double-check the bill amount and due date.

- Set reminders. If you don’t automate a payment, set calendar alerts so you don’t forget.

- Track your recurring payments. Make a simple list in your notes or budgeting app to track your spending and gain control of your finances

- Keep payment info updated. If your debit or credit card expires, update your accounts to avoid failed payments.

How to Stay Safe When Paying Bills Online

Online bill pay is safe — but only if you take basic precautions:

- Use secure connections — avoid public Wi-Fi when making payments.

- Create strong, unique passwords for your bank and provider accounts.

- Enable two-factor authentication (2FA) when possible.

- Regularly monitor your bank account for unauthorized charges.

- Be alert for phishing emails that pretend to be from your bank or biller.

Pro tip:Bookmark official bank and biller sites so you don’t accidentally click on fake links.

What to Do If a Payment Goes Wrong

Sometimes mistakes happen — here’s what to do if a payment fails, is late, or is incorrect:

- Contact your bank or provider immediately. Many banks can help stop or reverse a payment if caught quickly.

- Check the fine print. Some companies charge late fees even if the bank sent the payment — double-check if it was received on time.

- Document everything. Save confirmation emails and take screenshots if needed.

- Follow up until resolved. If necessary, escalate your complaint through customer service or a formal dispute.

Real Examples of Payment Issues

Here are some common situations where something can go wrong with an online bill payment — and what you can do about it:

- You paid the wrong amount: Example: You accidentally entered $250 instead of $25 for a utility bill. Contact your utility provider immediately — many companies can issue a refund or credit the extra amount toward your next bill.

- Your automatic payment failed: Example: Your debit card expired and the automatic payment for your internet bill failed. Update your card information and manually make the payment to avoid service interruption. Then verify that your next automatic payment is set up correctly.

- Late payment due to system error: Example: You scheduled a payment through your bank, but it didn’t arrive on time due to a processing delay. Call your bank and the service provider. Ask the provider to waive the late fee and confirm when they received the payment.

- Fraudulent charge detected: Example: You see a charge on your account for a bill you didn’t authorize. Contact your bank immediately to dispute the transaction and request a chargeback. Also notify the biller to prevent further fraudulent activity.

Resources

Advertiser Disclosure

Save time & avoid late fees

Government-backed guide to paying bills securely online and avoiding scams. Online Bill Pay Safety Tips (CFPB)

Zelle is widely used for rent, shared bills, and personal transactions. Good to explain what it is and how to use it responsibly.