What Is the 50/30/20 Budget Rule?

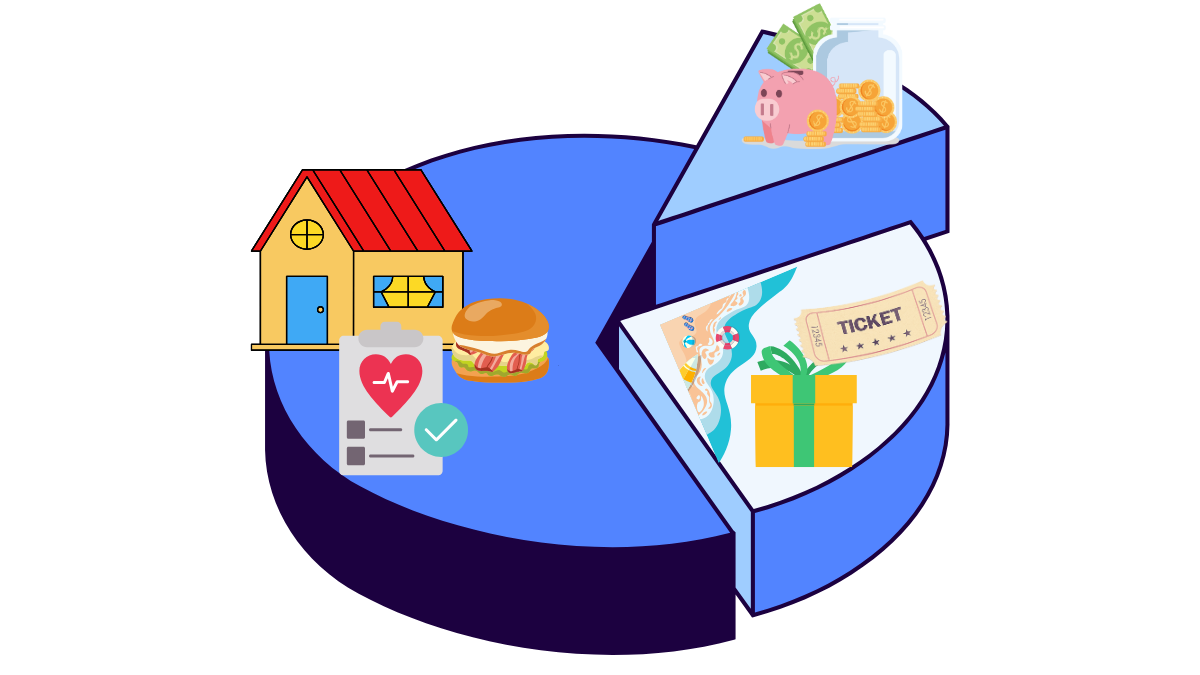

The 50/30/20 budget rule is a straightforward budgeting method that divides your after-tax income into three categories:

- 50% for Needs: Essential expenses like housing, utilities, groceries, and transportation.

- 30% for Wants: Non-essential spending, such as dining out, entertainment, and hobbies

- 20% for Savings and Debt Repayment: Money allocated to savings, investments, or paying off debt beyond minimum payments.

Introduced by Senator Elizabeth Warren and her daughter Amelia Warren Tyagi in their book All Your Worth: The Ultimate Lifetime Money Plan, this rule simplifies budgeting by providing clear percentages to guide spending and saving.

Why It Matters: The 50/30/20 rule helps you balance necessities, lifestyle, and financial goals without complex calculations, making it ideal for beginners and seasoned budgeters alike.How It Works in Practice

Let’s say you bring home $3,000/month after taxes:

- $1,500 (50%) goes toward needs like rent, groceries, insurance, utilities, minimum debt payments

- $900 (30%) can be used for wants like dining out, entertainment, shopping, subscriptions

- $600 (20%) is for savings, retirement contributions, or paying extra on debt

Why the 50/30/20 Rule Became So Popular

This method gained traction because it removes the guesswork. You don’t need to categorize every single transaction. Instead, you focus on your overall money flow — where it’s going, and how much is being saved.

The 50/30/20 rule was first introduced to the public by Senator Elizabeth Warren and her daughter Amelia Warren Tyagi in the book All Your Worth: The Ultimate Lifetime Money Plan. It was originally designed to help middle-class Americans navigate personal finance with more clarity and less stress.

The concept quickly resonated with:

- Busy professionals who needed a quick budgeting system

- Young adults and college grads just starting out

- People rebuilding after debt or financial setbacks

- Families looking to simplify their household finances

Why It Caught On (Fast)

Let’s look at why it became the “go-to” framework for so many people:

- 1. It’s Easy to Remember: Three categories. Clear percentages. No math degree required.

- 2. It Works with Real Life:Whether you’re earning $2,000/month or $10,000/month, you can apply the structure immediately.

- 3. It’s Flexible: You’re not told exactly what to cut — you get to decide what’s a “want” vs. a “need” based on your life.

- 4. It Bridges the Gap: Unlike restrictive budgets that focus only on cutting spending, this rule encourages balance: spending, saving, and living — all at once.

Breaking Down the Categories (Needs, Wants, Savings)

1. Needs (50%)

These are non-negotiable expenses required to maintain your basic standard of living:- Housing: Rent or mortgage payments.

- Utilities: Electricity, water, internet, and phone bills.

- Groceries: Essential food and household items.

- Transportation: Car payments, gas, public transit, or maintenance.

- Insurance: Health, auto, or renters insurance.

- Minimum Debt Payments: Credit card or loan minimums.

2. Wants (30%)

These are discretionary expenses that enhance your lifestyle:

- Dining Out: Restaurants, takeout, or coffee shops.

- Entertainment: Streaming services, concerts, or movie tickets.

- Hobbies: Gym memberships, art supplies, or sports equipment.

- Travel: Vacations or weekend getaways.

- Shopping: Non-essential clothing or gadgets.

3. Savings and Debt Repayment (20%)

This category focuses on building financial security:

- Emergency Fund: Aim for 3–6 months of expenses.

- Retirement Savings: Contributions to 401(k), IRA, or other plans.

- Investments: Stocks, bonds, or other wealth-building vehicles.

- Extra Debt Payments: Paying more than the minimum on loans or credit cards.

When the Rule Works Well (And Who It’s For)

The 50/30/20 rule shines when you’re looking for a simple, balanced, and realistic framework — especially if you’re starting out or rebuilding your finances. But like any tool, it works best in the right context.

When the Rule Works Really Well

- You Have a Steady Income: If your paycheck is consistent each month (salaried or stable hourly work), the fixed percentages make tracking super easy. You can automate transfers and set spending limits that match your flow.

- You’re New to Budgeting: For beginners, this rule avoids overwhelm. Instead of breaking down 50+ line items, you’re just asking: “Is this a need, want, or saving?” That alone builds stronger financial awareness.

- You Want to Build Financial Habits: By consistently allocating 20% toward savings or debt, this method trains your brain to pay yourself first — which is one of the core behaviors of long-term financial success.

- You Don’t Want to Track Every Dollar: If tracking every grocery trip sounds exhausting, this rule offers a higher-level alternative. You get clarity without micromanagement.

Who Benefits Most From 50/30/20?

This framework is especially helpful for:

- Young professionals who are learning how to manage money on their own

- Couples combining finances for the first time and looking for shared structure

- Busy people who don’t want to spend hours budgeting

- Anyone rebuilding after debt, divorce, or job changes

- Freelancers with a set draw (e.g., you pay yourself a regular monthly income from business revenue)

If your goals are moderate — like building an emergency fund, contributing to a 401(k), and still enjoying life — the 50/30/20 rule helps you keep progress and pleasure in balance.

Think of it like a budgeting “autopilot” — great for cruising forward if your route is smooth.

When the 50/30/20 Rule Doesn’t Work

As useful as the 50/30/20 rule is, it’s not one-size-fits-all. In some situations, sticking rigidly to this structure can cause more harm than good — or simply fall apart when your reality doesn’t match the ratios.

When Your Income Is Too Low

If your after-tax income doesn’t cover basic living costs, 50% for needs won’t be enough — let alone 30% for wants.

Example: Someone earning $1,800/month after taxes may need to spend 70–80% on rent, transportation, and groceries just to stay afloat.In these cases, the focus needs to shift toward:

- Meeting essential needs

- Reducing fixed costs

- Finding local aid, assistance, or temporary side income

- Pausing “wants” spending altogether

When You Live in a High-Cost Area

If you’re in a city like San Francisco, New York, or Miami, housing costs alone can eat up 40–60% of your budget.

In this case:

- You may need a 70/20/10 or 60/25/15 split

- Or treat savings as a non-percentage goal (e.g., “Save $200/month no matter what”)

When You Have Aggressive Financial Goals

Trying to retire early? Pay off debt fast? Save for a home in two years?

The standard 20% savings might not be enough. You may want to flip the script:

- 40% needs

- 20% wants

- 40% savings/investing/debt payoff

When You Have Irregular Income

Freelancers, gig workers, or anyone with seasonal/variable income may find it hard to assign percentages each month.

Instead, a better approach might be:

- Build a baseline monthly budget from your lowest average income

- Use a rolling average or buffer to smooth out the highs and lows

- Prioritize savings first during “up” months to cover leaner ones

When You Have Complex Financial Responsibilities

If you’re supporting family members, paying off large medical bills, or juggling multiple financial goals, a flat 50/30/20 model may not reflect your priorities.

In this case, a customized budget built from the ground up (needs-first or goals-first) often works better.

Bottom Line: The 50/30/20 rule is a guide, not a mandate. Your budget should adapt to your reality — not the other way around.How to Adjust the Rule to Fit Your Life

If the 50/30/20 rule doesn’t align with your situation, try these tweaks:

- Shift Percentages: Adjust to 60/20/20 or 50/20/30 based on your needs or goals. For example, high earners might use 40/30/30 to boost savings.

- Prioritize Debt: If debt is a burden, allocate more than 20% to repayments, cutting back on wants temporarily.

- Combine Categories: In low-income scenarios, blend needs and wants to focus on essentials and savings.

- Use Absolute Numbers: Instead of percentages, set fixed dollar amounts for each category based on your priorities.

- Track and Tweak: Use budgeting apps like Mint or YNAB to monitor spending and adjust monthly.

Common Adjusted Budget Ratios

Depending on your stage in life, these adjusted versions of the 50/30/20 rule might work better: TABLE Budget Type Needs Wants Savings/Debt High-Cost of Living 60% 25% 15% Aggressive Saver 40% 20% 40% Paying Off Debt Fast 50% 15% 35% Single Parent Budget 65% 20% 15% Retirement Focused 45% 20% 35%

Real-World Budget Examples

Sometimes the best way to understand a budgeting method is to see it in action. Whether you’re earning $2,500 or $8,000 a month, here’s how the 50/30/20 rule — and its custom variations — can apply in real life.

Single Professional

- Income: $4,000/month after taxes

- Needs (50%): $2,000 (rent: $1,200, groceries: $400, utilities: $200, transportation: $200)

- Wants (30%): $1,200 (dining out: $300, streaming: $50, gym: $100, travel fund: $750)

- Savings/Debt (20%): $800 (emergency fund: $400, retirement: $400)

Family of Four

- Income: $6,000/month after taxes

- Needs (50%): $3,000 (mortgage: $1,800, groceries: $800, utilities: $300, insurance: $100)

- Wants (30%): $1,800 (family outings: $500, kids’ activities: $600, subscriptions: $200, misc.: $500)

- Savings/Debt (20%): $1,200 (college fund: $600, debt repayment: $600)`

Low-Income Earner

- Income: $2,000/month after taxes

- Adjusted Budget (60/20/20): $1,200 needs (rent: $800, groceries: $300, bus pass: $100), $400 wants (dining: $200, hobbies: $200), $400 savings (emergency fund: $300, debt: $100)

- 70/20/10 Rule: 70% for living expenses, 20% for debt/savings, 10% for giving or investments.

- Envelope System: Use cash for specific categories (e.g., groceries, entertainment) to limit overspending.

- Pay-Yourself-First Budget: Prioritize savings or debt repayment before allocating funds to other categories.

- 80/20 Rule: 80% for all expenses (needs + wants), 20% for savings/debt.

Make the 50/30/20 Rule Work for You

The 50/30/20 budget rule is a powerful starting point for managing your finances, offering simplicity and balance. While it’s not perfect for everyone, its flexibility allows you to adapt it to your unique circumstances. By understanding its categories, strengths, and limitations, and exploring alternatives, you can craft a budget that aligns with your goals.

Try the 50/30/20 rule for one month using a budgeting app like Mint or a simple spreadsheet. Adjust as needed and share your experience in the comments! For more budgeting tips, check out our guides on debt repayment strategies (#) or building an emergency fund (#).

A beginner-friendly guide from the U.S. government that explains how to create a basic budget and track expenses.

Learn More

Use this interactive tool to see how your spending stacks up against the 50/30/20 rule and adjust your numbers in real time.

Learn More

A powerful zero-based budgeting app that helps you give every dollar a job and plan ahead for irregular expenses.

Learn More