Why Building Credit Matters

Building credit is one of the most important steps toward financial freedom. A strong credit profile can open many doors and save you money over time. Here's why it matters:

Qualify for loans and credit cards with better terms

Lenders use your credit score to assess how risky it is to lend to you. A higher credit score helps you qualify for lower interest rates, higher credit limits, and better loan terms.

For example, a strong score can help you get a credit card with cash-back rewards, a 0% intro APR, or a high-limit card that improves your credit utilization. It also affects large loans like a mortgage— a lower interest rate here could save you tens of thousands of dollars over the life of the loan.

Rent an apartment without needing a large deposit

Landlords often check your credit report during the rental application process. If you have good credit, you’re viewed as more likely to pay rent on time, which can result in waived or lower security deposits. Without good credit, you may be required to provide a large upfront deposit, find a co-signer, or may even be denied housing in competitive rental markets.

Get lower insurance rates

In many U.S. states, insurance companies use a version of your credit score, called a credit-based insurance score, to help determine your premiums. Why? Studies show that people with better credit tend to file fewer claims and are considered lower risk. As a result, having good credit can help you qualify for lower monthly premiums on auto insurance, homeowners insurance, and even renters insurance. Over time, this can add up to hundreds or even thousands of dollars in savings.

Save money on interest

The lower your credit score, the higher the interest rate lenders typically charge to offset risk. This is especially significant for large purchases such as a home, car, or personal loan.

For example, the difference between an excellent credit score and a fair score could mean paying an extra $100–$300 per month on a 30-year mortgage. Even on credit cards, a lower interest rate helps you save when carrying a balance.

In short: good credit lets you borrow money more affordably, keeping more cash in your pocket.

If you carry a balance month to month, it’s especially important to

understand why paying more than the minimum matters.

Build trust with lenders and financial institutions

Having a strong credit profile sends a clear signal to banks, credit unions, and other financial institutions that you are a responsible and trustworthy borrower. This can make it easier to get approved for new credit, negotiate better terms, or be offered exclusive financial products that are only available to top-tier customers — such as premium credit cards, higher savings account yields, or VIP loan offers. A positive credit history can also build trust with employers (in industries where credit checks are allowed), utility companies, and landlords.

How Credit Scores Work

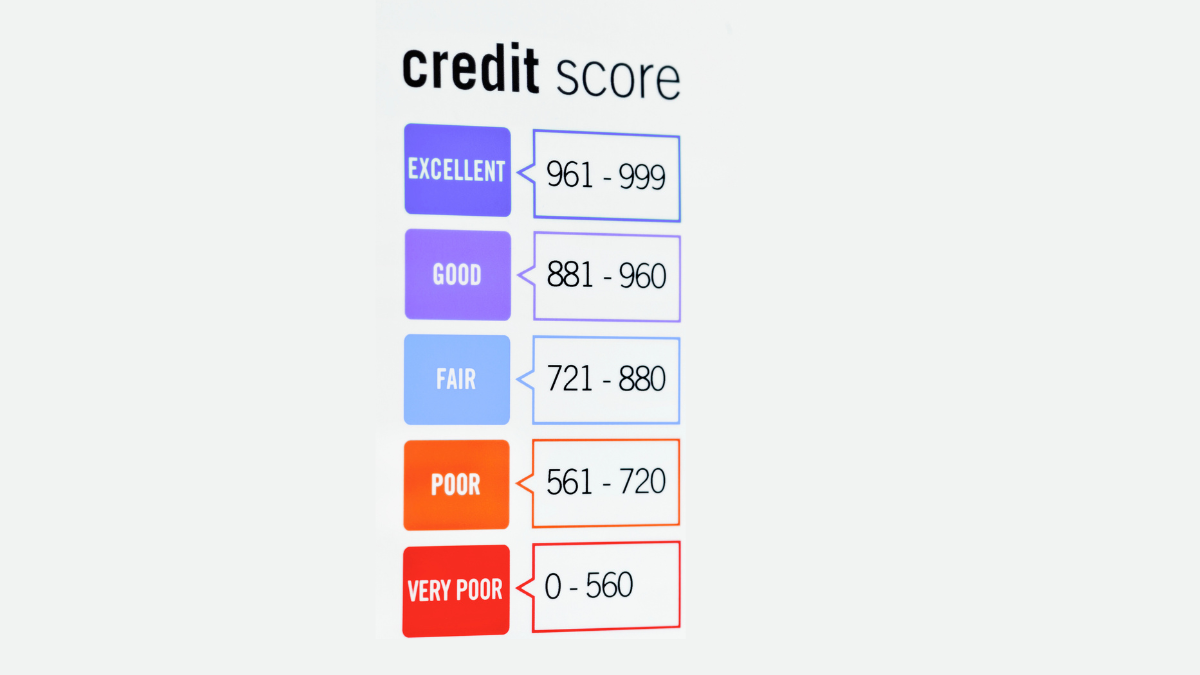

Your credit score is a three-digit number that reflects how likely you are to repay borrowed money. It’s used by banks, landlords, lenders, and even some employers to evaluate your financial behavior. The most common type is the FICO® Score, which ranges from 300 (poor) to 850 (excellent).

The higher your score, the more trustworthy you appear to lenders — and the more likely you are to qualify for better credit terms, lower interest rates, and more financial opportunities.

Factors That Affect Your Credit Score

Your credit score is calculated based on five major components. Understanding each one can help you build and protect your score over time:

| Factor | Weight | Explanation |

|---|---|---|

| Payment History | 35% | Whether you pay your bills on time. Even one missed or late payment can seriously hurt your score. Lenders see this as the most important sign of responsibility. |

| Amounts Owed (Utilization) | 30% | How much of your available credit you’re using. Keeping credit card balances below 30% of your credit limit is ideal. Lower is better. |

| Length of Credit History | 15% | How long your credit accounts have been active. Older accounts help build trust, so avoid closing long-standing credit cards. |

| Credit Mix | 10% | A variety of credit types — like credit cards, installment loans, and mortgages — shows that you can handle different financial products responsibly. |

| New Credit (Inquiries) | 10% | How often you apply for new credit. Each hard inquiry can temporarily lower your score, so avoid applying for multiple accounts in a short time span. |

Together, these five factors give lenders a complete picture of your borrowing behavior — past, present, and potential risk.

How to Start Building Credit from Scratch

If you have no credit history, don’t worry — everyone starts somewhere. The key is to build a record of responsible borrowing that credit bureaus can track. Here are four proven ways to get started:

1. Apply for a secured credit card

Build credit with a refundable security deposit

A secured credit card is specifically designed for people with no credit or poor credit. To open one, you make a refundable cash deposit (typically $200–$500), which acts as your credit limit.

You can use the card for small purchases — and the key is to pay the full balance on time every month. Doing so shows lenders you’re trustworthy and helps you establish a positive payment history, which is the most important part of your credit score. After several months of responsible use, many issuers will let you upgrade to a regular (unsecured) card and return your deposit.

Pro tip: Keep your utilization low (below 30%) and set up automatic payments to avoid missing due dates.

2. Become an authorized user

Boost your credit by “piggybacking” on someone else’s account

Ask a close friend, partner, or family member with good credit to add you as an authorized user on their credit card. You don’t need to use the card — just being added allows their positive payment history, credit limit, and account age to appear on your credit report. This can help build your score fast, especially if the card has been open for a long time and has low utilization.

Important: Only do this with someone who always pays on time and keeps their balance low — otherwise, it could hurt your credit instead of helping it.

3. Apply for a credit-builder loan

Build payment history through small, low-risk installments

A credit-builder loan is a special loan designed to help you build credit. Instead of giving you money upfront, the lender places the loan amount (like $300–$1,000) in a locked savings account. You then make monthly payments toward that amount — and once you’ve paid in full, you receive the money. Every on-time payment is reported to the credit bureaus, helping you build a positive track record.

Look for: Local credit unions, community banks, or fintech apps that offer these loans with no hard credit check and low fees.

4. Report rent and utility payments

Get credit for bills you already pay

Most landlords and utility companies don’t report your payments to credit bureaus by default — but you can use services that do it for you. Platforms like Experian Boost, RentTrack, or Self allow you to report things like rent, water, internet, and electricity to the major credit bureaus. These payments can help improve your score, especially if you have thin credit history.

Tip: These services won’t replace credit cards or loans, but they can help add depth to your profile and show consistent financial behavior.

Tips to Build Credit Responsibly

Once you start building credit, follow these best practices to grow and protect your score over time:

- Pay on time — Even one late payment can hurt your score and stay on your credit report for up to seven years. Set up automatic reminders or auto-pay to never miss a due date.

- Keep credit utilization low — Aim to use no more than 30% of your total available credit across all cards. The lower, the better — high balances signal financial stress to lenders.

- Avoid opening too many accounts at once — Each new credit application triggers a “hard inquiry,” which can temporarily lower your score and make you look risky to lenders.

- Check your credit reports regularly — Visit AnnualCreditReport.com to review your reports for free. Catch and dispute any errors that could damage your score.

- Maintain a healthy credit mix — Having both revolving credit (like credit cards) and installment loans (like personal or auto loans) shows that you can handle different types of debt responsibly.

Common Mistakes to Avoid

Building credit takes time — and while small wins help, common mistakes can set you back fast. Avoid these pitfalls:

- Missing payments — The single biggest factor affecting your score. Even one late payment can stay on your credit report for years and drag your score down.

- Maxing out credit cards — High utilization makes you appear overextended, even if you’re making payments. Keep balances well below your credit limit.

- Closing old accounts — This can shorten your credit history and reduce your total available credit, both of which can hurt your score.

- Applying for too much credit too quickly — Every application triggers a hard inquiry. Too many in a short time can make you seem financially desperate.

- Ignoring your credit report — Mistakes like incorrect balances or accounts that don’t belong to you can lower your score. Check regularly and dispute any errors.

How Long Does It Take to Build Good Credit?

Building good credit doesn’t happen overnight. It’s a long-term process that rewards consistency, discipline, and time. While you can start seeing results within a few months, reaching a high credit score often takes years of responsible financial behavior.

Here’s a breakdown of what to expect:

| Milestone | Typical Timeframe | What It Means |

|---|---|---|

| First credit account opened | Instantly starts history | As soon as you’re approved for your first credit product (like a secured card or credit-builder loan), you officially begin building a credit profile. But you won't have a score yet — that takes a bit more time. |

| Establishing a basic score | 3–6 months | After 3–6 months of credit activity, the bureaus can generate your first credit score — assuming the lender reports your activity. This score is often modest, but it’s the foundation for future growth. |

| Reaching 650–700 (fair to good) | 12–24 months | With steady on-time payments and low utilization, your score can climb into the “fair” or “good” range in about 1–2 years. This is the point where better credit cards and loan rates become available. |

| Reaching 750+ (excellent) | 3+ years | Reaching the "excellent" range requires a longer credit history, mix of credit types, and a near-flawless record of payments. The key is to stay consistent — no missed payments, low utilization, and smart borrowing behavior. |

Reminder: Credit history rewards time. The longer your accounts stay open and in good standing, the stronger your score becomes.

Advanced Strategies for Faster Credit Growth

If you want to move beyond the basics and grow your credit score faster, these strategies can help you build momentum — especially once you’ve established your first credit accounts.

1. Ask for credit line increases

→ More available credit = lower utilization ratio

Requesting a credit limit increase on your existing cards can instantly improve your credit utilization, which makes up 30% of your score. You don’t need to spend more — the goal is to increase your available credit while keeping your spending the same. Most issuers allow you to request a limit increase through their app or website, and in many cases, they don’t do a hard inquiry.

Pro tip: Wait until you’ve had the card at least 6 months and have a history of on-time payments before requesting an increase.

2. Use multiple cards responsibly

→ Spread usage and improve your credit mix

Having more than one credit card — and using them wisely — can help you in two ways: it spreads your spending across multiple limits (which lowers utilization), and it shows that you can manage more than one account responsibly. This contributes to both utilization and credit mix.

Pro tip: Pay each balance in full and on time to avoid interest and missed payments.

3. Keep old accounts open

→ Your credit age matters — don’t cut it short

The length of your credit history makes up 15% of your score. Closing your oldest credit cards (especially ones in good standing) can hurt you by reducing both the age of your accounts and your total available credit. Even if you don’t use an old card often, it’s usually best to leave it open with no balance.

Exception: Only close the account if it has an annual fee and you're not getting enough value from it.

4. Leverage credit-builder tools and apps

→ Add more data to your file (even without new credit)

If you're still building a thin credit profile, you can add positive payment history by using tools like Experian Boost, Self, or Grow Credit. These apps allow you to report things like rent, utilities, phone bills, and subscriptions — which can strengthen your score, especially with Experian.

Note: These tools don’t replace traditional credit accounts, but they can provide a helpful boost — especially for younger credit files.

5. Pay multiple times per month

→ Lower reported balances before your statement closes

Even if you pay your balance in full each month, your issuer may report a high balance if you’ve used a large portion of your credit line. To avoid this, you can make multiple payments during the billing cycle — such as once halfway through and again before the statement closing date. This keeps your utilization low at all times, not just when the payment is due.

Strategy: Especially helpful if you use your card often but want to appear low-risk to credit bureaus.

Resources

Advertiser Disclosure

This is the only official site where users can check their credit reports from Equifax, Experian, and TransUnion for free.

Explains how credit scores are calculated, what affects them, and how to build credit responsibly.

A leading credit bureau with actionable tips for those starting with no credit history or rebuilding credit.